Infrastructure Funding, Finance and Institutional Investment - a new guide by Professor Brian Scott-Quinn

Infrastructure is the new buzzword in finance these days even though infrastructure has been important at least since the days when the Romans built their roads across Britain and Europe. The difference today is that increasingly the government says it cannot finance such infrastructure - roads, railways, power generation, telecoms, airports etc. The telecoms industry is already completely privately owned in most countries as are an increasing number of airports across the world. But governments everywhere are now looking ever more to public private partnerships (PPPs) to provide the annual funding (the annual revenues required to service bank loan and bond interest payments and capital repayments and equity dividends) as well as the actual financing (the arranging of bank loans, bond issues and equity share issues) to provide the cash up-front.

Infrastructure is the new buzzword in finance these days even though infrastructure has been important at least since the days when the Romans built their roads across Britain and Europe. The difference today is that increasingly the government says it cannot finance such infrastructure - roads, railways, power generation, telecoms, airports etc. The telecoms industry is already completely privately owned in most countries as are an increasing number of airports across the world. But governments everywhere are now looking ever more to public private partnerships (PPPs) to provide the annual funding (the annual revenues required to service bank loan and bond interest payments and capital repayments and equity dividends) as well as the actual financing (the arranging of bank loans, bond issues and equity share issues) to provide the cash up-front.

Even in urban public transport projects such as Crossrail 1 and 2 in London, the private sector is involved. In Crossrail 2, the government has said it will provide 50% of the finance but the private sector (customers, retail stores in stations, business rate payers with supplemental business rates to capture land value increases etc.) are expected to fund the balance. While most roads will remain in the public sector, more toll roads may be built and these will be constructed as public private partnership (PPP) concessions.

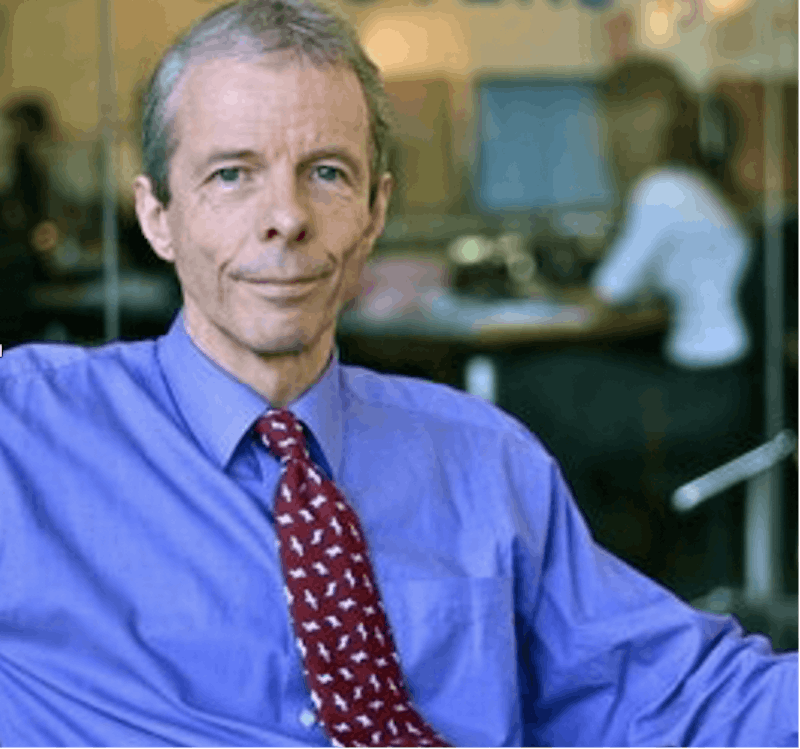

Two capital market trade associations - the Association of Financial Markets in Europe (AFME) and the International Capital Market Association (ICMA) commissioned Professor Brian Scott-Quinn to write a Guide to Infrastructure Financing which was published in July 2015. This was one element of these two trade associations' contribution in support of the European Union growth agenda. The two trade associations are also strongly supportive of the European Commissions's Investment Plan for Europe and the establishment of the € 315bn European Fund for Strategic Investments (EFSI). The purpose of the Guide, therefore is to contribute to the work of EFSI by facilitating the raising of private sector finance for infrastructure projects in which EFSI invests.

Brian Scott-Quinn and his research assistant, Deyber Cano are very grateful to the AFME-ICMA Infrastructure Working Group comprising bankers, investors, law firms, rating agencies and other market participants who made an invaluable contribution to the content of the Guide. They also provided guidance in its structuring and helped with gaining access for interview to those involved in the business of enhancing European growth and the quality of life of its citizens through the expansion of infrastructure provision.

Professor Brian Scott-Quinn

Reading, August 2015

Click here to download the Guide to infrastructure financing

Infrastructure is the new buzzword in finance these days even though infrastructure has been important at least since the days when the Romans built their roads across Britain and Europe. The difference today is that increasingly the government says it cannot finance such infrastructure - roads, railways, power generation, telecoms, airports etc. The telecoms industry is already completely privately owned in most countries as are an increasing number of airports across the world. But governments everywhere are now looking ever more to public private partnerships (PPPs) to provide the annual funding (the annual revenues required to service bank loan and bond interest payments and capital repayments and equity dividends) as well as the actual financing (the arranging of bank loans, bond issues and equity share issues) to provide the cash up-front.

Even in urban public transport projects such as Crossrail 1 and 2 in London, the private sector is involved. In Crossrail 2, the government has said it will provide 50% of the finance but the private sector (customers, retail stores in stations, business rate payers with supplemental business rates to capture land value increases etc.) are expected to fund the balance. While most roads will remain in the public sector, more toll roads may be built and these will be constructed as public private partnership (PPP) concessions.

Two capital market trade associations - the Association of Financial Markets in Europe (AFME) and the International Capital Market Association (ICMA) commissioned Professor Brian Scott-Quinn to write a Guide to Infrastructure Financing which was published in July 2015. This was one element of these two trade associations' contribution in support of the European Union growth agenda. The two trade associations are also strongly supportive of the European Commissions's Investment Plan for Europe and the establishment of the € 315bn European Fund for Strategic Investments (EFSI). The purpose of the Guide, therefore is to contribute to the work of EFSI by facilitating the raising of private sector finance for infrastructure projects in which EFSI invests.

Brian Scott-Quinn and his research assistant, Deyber Cano are very grateful to the AFME-ICMA Infrastructure Working Group comprising bankers, investors, law firms, rating agencies and other market participants who made an invaluable contribution to the content of the Guide. They also provided guidance in its structuring and helped with gaining access for interview to those involved in the business of enhancing European growth and the quality of life of its citizens through the expansion of infrastructure provision.

Professor Brian Scott-Quinn

Reading, August 2015

Click here to download the Guide to infrastructure financing

You might also like

Populism Vs Data Science

School students take on the stock market in local Business School competition

ICMA Centre lecturer presents in Corporate Social Responsibility and Shipping Symposium

This site uses cookies to improve your user experience. By using this site you agree to these cookies being set. You can read more about what cookies we use here. If you do not wish to accept cookies from this site please either disable cookies or refrain from using the site.